sacramento property tax rate 2020

This table shows the total sales tax rates for all cities and towns in. 10000 485208.

In San Francisco Living On A Hill Dramatically Decreases The Crime Rate San Francisco Map Francisco San Francisco

Sacramento County to apportion and allocate property tax revenues for the period of July 1 2016 through June 30 2019.

. The 825 sales tax rate in Sacramento consists of 600 California state sales tax 025 Sacramento County sales tax 050 Sacramento tax and 150 Special tax. 1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 27 2019. As seen from Mashvisors data Sacramentos average rental income for traditional and Airbnb respectively are 1534 and 2671.

Luckily for investors the Sacramento housing market 2020 has plenty of rental income. Its also home to the state capital of California. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00232 los rios coll gob 00232 los rios coll gob 00232 sacto unified gob 01139 sacto unified gob 01139 sacto unified gob 01139.

Ad Search Sacramento County Records Online - Results In Minutes. Sacramento County has one of the highest median property taxes in the United States and is ranked 359th of the 3143 counties in order of. 00249 12082.

This tax is charged on all NON-Exempt real property transfers that take place in the City limits. What is California property tax rate 2020. Permits and Taxes facilitates the collection of this fee.

For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Los Rios Coll Gob. Revenue and Taxation Code Section 72031 Operative 7104 Total.

The average effective property tax rate in California is 073 compared to the national rate which sits at 107. PROPERTY TAX DEPARTMENT. Sacramento County is located in northern California and has a population of just over 15 million people.

The California sales tax rate is currently 6. 2020-21 CALIFORNIA CONSUMER PRICE INDEX Revenue and Taxation Code section 51 provides that base year values determined under. Our audit found instances of noncompliance with California statutes for.

Sacramento houses for sale will also benefit from appreciation in 2020. California has a 6 sales tax and Sacramento County collects an additional 025 so the minimum sales tax rate in Sacramento County is 625 not including any city or special district taxes. View the E-Prop-Tax page for more information.

Revenue and Taxation Code Sections 605115 620115. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Tax Collection and Licensing.

City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The minimum combined 2022 sales tax rate for Sacramento California is 875. They can be reached Monday 100 pm - 400 pm and Tuesday - Friday.

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well 2020-59. 450 N STREET SACRAMENTO CALIFORNIA. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc.

The County sales tax rate is 025. Tax rate Tax amount. 00918 44542.

025 to county transportation funds. Order setting tax rate for the county of johnson for the 2020 tax year and directing the assessment and collection thereof. Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information.

075 to city or county operations. Find Sacramento County Property Tax Info From 2021. This is the total of state county and city sales tax rates.

You can print a 825 sales tax table here. The total sales tax rate in any given location can be broken down into state county city and special district rates. Look up the current sales and use tax rate by address.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1. California City County Sales Use Tax Rates effective January 1 2022 These rates may be outdated. PO BOX 942879 SACRAMENTO CALIFORNIA 94279-0064.

The Sacramento sales tax rate is 1. Since Jane Doe purchased the property on July 21 2010 she will be responsible for the property taxes on 14178120 250000 - 100000 150000365 41096 x 345 days 141781 based on the difference between the new assessed value and the old assessed value prorated from the time she purchased through the end of the FY 1011. Property Type 2020 2019 Change Change 2020 2019 Change Change Vacant Land - Residential 16832 16421 411 25 2150977648 2003590342 147387306 74 Single Family Residences 384023 380260 3763 10 115292649366 108723604319 6569045047 60.

The property tax rate in the county is 078. This tax has existed since 1978. The new district tax is for specified city limits and only affects the City of Sacramento.

Property Tax Bills Payments. Sacramento County collects on average 068 of a propertys assessed fair market value as property tax. Overview of California Taxes Californias overall property taxes are below the national average.

2021 Momentum 397th By Grand Design Uvw 15600 Lbs Hitch Weight 3375 Lbs Length 43 1 Grand Designs Grand Design Rv Design

Homeownership Rate In The U S Climbs To Highest Since 2013 Home Ownership Mortgage California

Best Buy Cities Where To Invest In Housing In 2017 Where To Invest Investing Real Estate Investing

Health Insurance For Flood Victims Health Insurance Health Insurance Plans Medical Insurance

Pin On Personal Finance Infographics

Pin On Mapas Planos E Infograficas

Employee Verification Letter Letter Template Word Printable Letter Templates Lettering

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Want To Protect Your Home From Dampness Home Insurance Household Notebook Home Buying

The Best And Worst U S States For Taxpayers Tax Deadline States Virginian Pilot

Non Standard Auto Insurance Companies In California

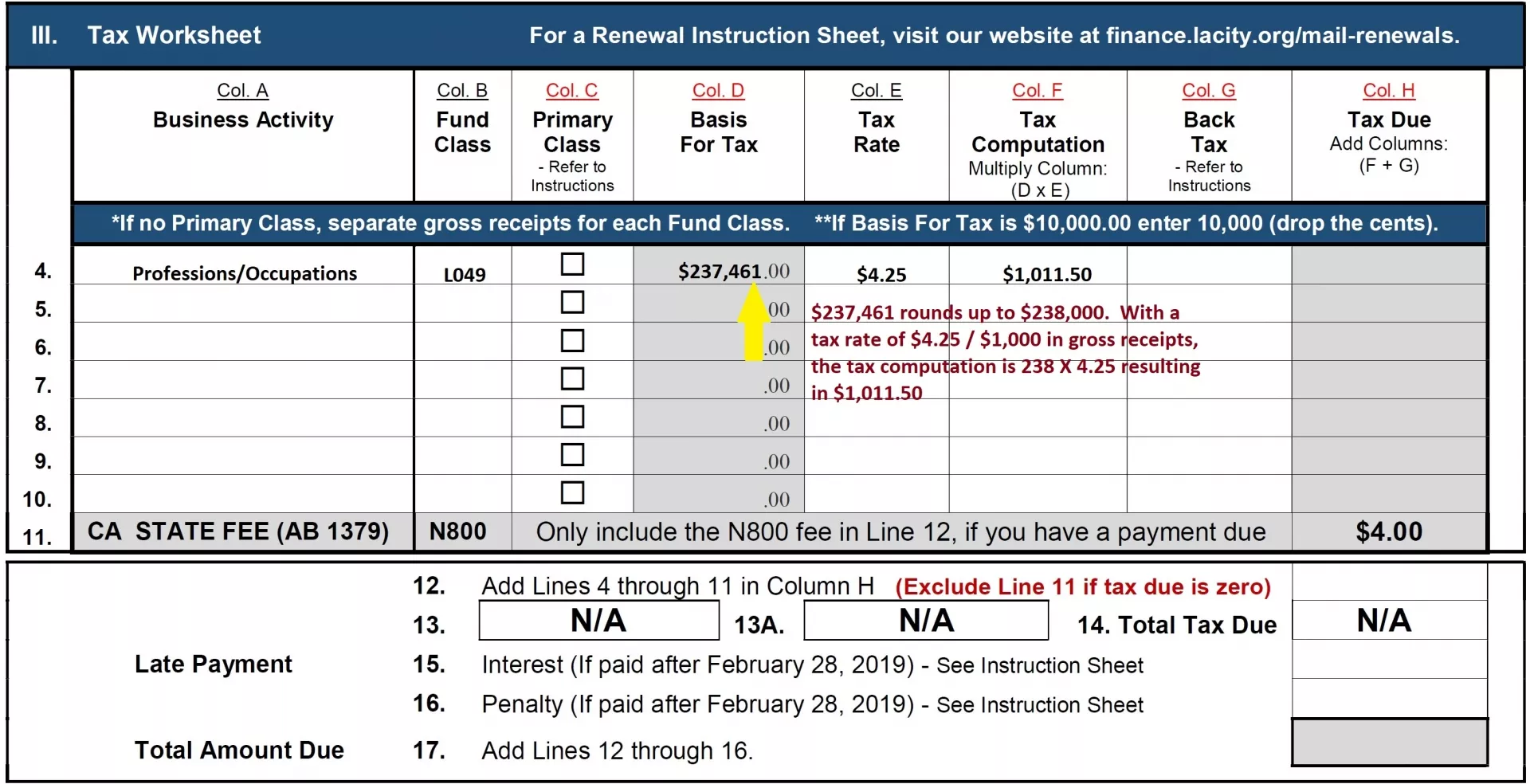

Business Tax Renewal Instructions Los Angeles Office Of Finance

Yes There Is However Things Are Not As Simple As They Look As We Have Mentioned Above Certain Laws Are Governing I Gestao Tributaria Investimento Economia

Best Cpa In Carson County Nv Business Valuation Nevada Cpa

Community Zoom Community Social Media Graphics Templates

Pin By Celebrity On Car Donation Insurance Claim Car Insurance Auto Insurance Quotes

Real Estate Market In Roseville Ca In Fall 2020 Kaye Swain Sun City Roseville Real Estate Marketing

Partnership Firm Registration In India Sole Proprietorship Partnership Firm